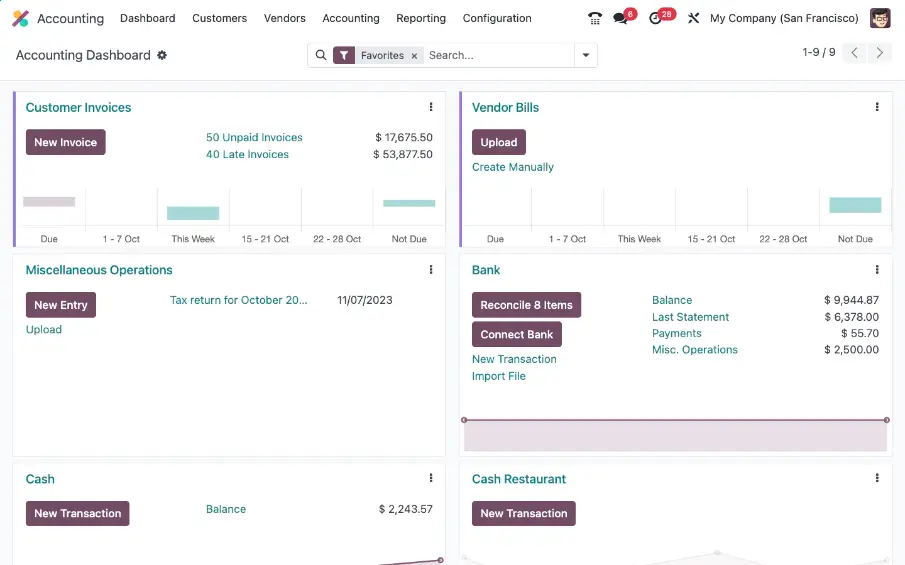

Smart bank reconciliation

Admitted in

28,000 banks

Bank synchronization

There's no need import your bank statements manually, Odoo will integrates with 28,000 banks around the world.

Smart reconciliation with artificial intelligence

95% of transactions are automatically reconciled with financial records.

Say goodbye to

draft_template.xlsx

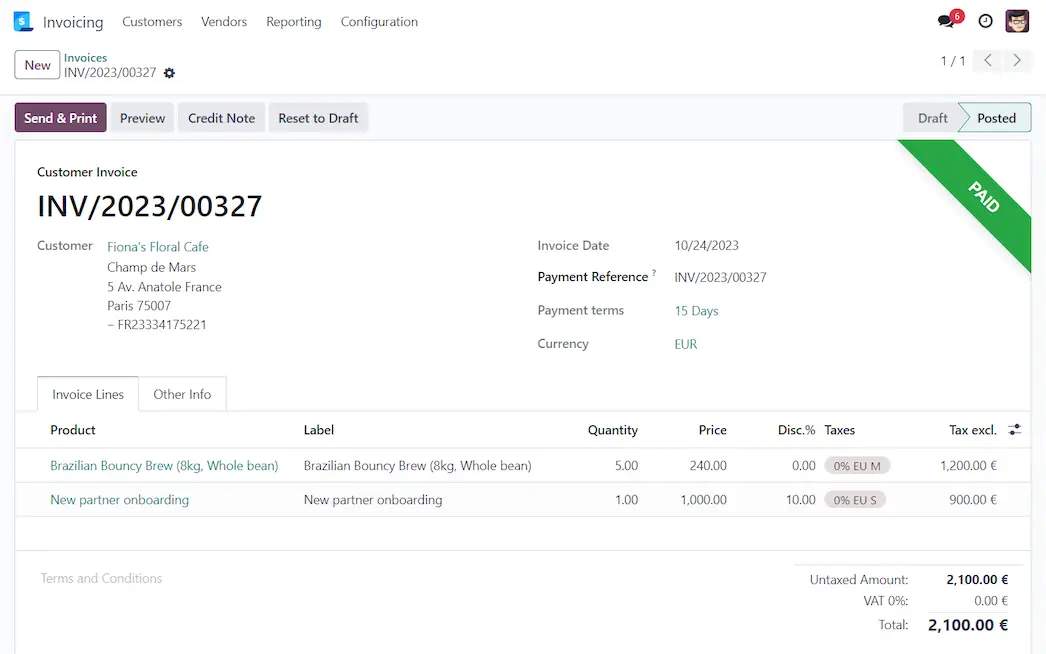

The Odoo Invoicing app will help you

simplify your accounting process. Create professional invoices,

Customize them to your liking and receive your payments faster.

A software business

well done.

Worldwide Compatibility

Odoo is already pre-configured for your country's requirements: charts of accounts, taxes, country-specific reports, e-invoicing, audit files, and tax positions to automatically apply the correct tax rates and accounts.

Automated follow-ups

Odoo will help you identify late payments and you can schedule and send reminders based on the number of days late. You can also send follow-up messages by different means, such as email, postal mail or SMS.

Postponements

Differentiate your income and expenses, either manually or in the validation of each invoice. You can also audit specific reporting entries.

Taxes and dynamic accounts

It doesn't matter where your customers or suppliers are from, if they have a tax identification number, if the goods will have to be imported... Odoo will calculate the correct taxes, income and expenses.

Real-time reports

With real-time financial performance reports you will not be afraid to make financial decisions for your company. Additionally, you can add notes, export, and enter detailed information for each report without any hassle.

Electronic invoicing (EDI)

There are several formats of

EDI files available depending on the country of your company. Send and

receive electronic invoices in various formats and standards, such as

Peppol. List of supported formats

We've combined KPMG's trusted experience and expertise with Odoo's innovative technology to help clients and prospects simplify their business operations, including real-time accounting available anytime, anywhere.

Wim Van den Brande

Director of KPMG Tax, Legal & Accountancy